What is the HCFA 1500 Form? A Complete Medical Billing Guide for 2026

In U.S. medical billing, few terms are as widely used—and misunderstood—as HCFA. Even in 2026, billing professionals, providers, and insurance companies continue to refer to the CMS-1500 professional claim form as the “HCFA form.” But what does HCFA actually mean, and why is it still relevant today? This guide explains the HCFA meaning in medical billing, how it relates to the CMS-1500 claim form, and why understanding HCFA remains essential for accurate claim submission, insurance reimbursement, and compliance across Medicare, Medicaid, and commercial payers.

HCFA Meaning in Medical Billing

HCFA stands for Health Care Financing Administration, a former U.S. federal agency responsible for administering Medicare and overseeing federal Medicaid policy. In medical billing, the term HCFA is still commonly used to refer to the CMS-1500 professional claim form, even though the agency itself was renamed in 2001.

When healthcare providers, billers, or insurance companies mention the “HCFA form,” they are almost always referring to the CMS-1500, which is used to submit outpatient and professional medical claims to Medicare, Medicaid, and commercial insurance payers.

Although HCFA no longer exists as an agency, its name remains deeply embedded in billing workflows, payer documentation, EHR systems, and everyday billing terminology across the U.S. healthcare system.

BLOG OUTLINE

- What is the HCFA 1500 Form?

- Is HCFA the Same as CMS-1500?

- Why the HCFA Form still matters in 2026

- Understanding the CMS-1500 (HCFA) Form

- How Many Boxes Are on the HCFA 1500 Form?

- What Does Each Box Refer to in the HCFA Form?

- What Is the Claim Number on a HCFA Form?

- How HCFA Relates to Insurance Companies

- State-Specific Differences in HCFA in Medical Billing

- Common HCFA Claim Errors and How to Avoid Them

- Submitting the HCFA 1500 Form: Manual vs. Electronic

- Conclusion

- Frequently Asked Questions about the HCFA Form

What Is the HCFA 1500 Form?

The HCFA 1500 form, officially known as the CMS-1500, is the standard health insurance claim form used by non-institutional healthcare providers to bill for professional and outpatient services. It is accepted by Medicare, Medicaid, and most commercial insurance companies across the United States.

Although the form is now maintained by Centers for Medicare & Medicaid Services, the term “HCFA 1500” is still widely used in medical billing to describe this claim format. Physicians, therapists, mental health providers, and outpatient clinics rely on the CMS-1500 to report diagnoses, procedures, charges, and provider information in a standardized way.

In simple terms, if a service is provided outside a hospital or facility setting, it is billed using the HCFA 1500 (CMS-1500) form. This form acts as the primary communication tool between providers and insurance payers for professional medical claims.

Is HCFA the Same as CMS-1500?

No, HCFA and CMS-1500 are not the same thing — but they are closely connected. HCFA refers to the Health Care Financing Administration, the former federal agency that originally developed the standardized professional medical claim form. In 2001, HCFA was renamed the Centers for Medicare & Medicaid Services (CMS). After that change, the claim form was officially renamed the CMS-1500. Despite the rebranding, the term “HCFA 1500” is still widely used in medical billing. Many providers, clearinghouses, billing platforms, and payer documents continue to reference the form by its original name out of habit and legacy usage.

| Attribute | Detail |

|---|---|

| Full Name | Health Care Financing Administration |

| Established | 1977 |

| Oversaw Programs | Medicare, Medicaid, and other federal health programs |

| Rebranded As | CMS (Centers for Medicare & Medicaid Services) in 2001 |

| Legacy in Billing | Introduced the original HCFA 1500 claim form |

✅ Quick Summary: “HCFA” is not the same as the CMS-1500 form, but it is the origin of it. The CMS-1500 is the modern version of the paper claim form that was created by HCFA.

Why the HCFA Form Still Matters in 2026

Even in a fully digital healthcare environment, the HCFA form (CMS-1500) remains the backbone of professional medical billing in the United States. In 2026, its structure continues to define how outpatient and professional claims are created, reviewed, and reimbursed by both public and private insurance payers.

1. The National Standard for Professional Claims

The CMS-1500, originally developed under HCFA, is still the required claim format for non-institutional services in 2026. Physicians, mental health providers, therapists, and outpatient clinics rely on this form to submit claims consistently across Medicare, Medicaid, and commercial insurers. Most electronic claims (837P) remain directly mapped to HCFA/CMS-1500 field logic

2. Embedded in Billing Systems and Clearinghouses

Modern practice management systems, EHRs, and clearinghouses continue to be built around HCFA field structure. Even when claims are submitted electronically, validation rules, payer edits, and rejection logic are still based on HCFA box-level accuracy, not free-form data entry. Under HCFA’s leadership:

- It became mandatory to use CPT, HCPCS, and ICD code for reimbursement.

- Diagnosis pointers (Box 24E) was introduced alongwith procedure linkage, and documentation rules.

- Use of Modifiers and place of service (POS) codes were introduced and made mandatory to assist payers in accurate claim processing and reimbursement. Explore list of all POS codes and learn what billing modifier is

- NPI tracking started being regulated.

These standards continue to drive billing accuracy and compliance with payer-specific rules.

3. Basis for MACs and Payer Relationships

Medicare Administrative Contractors (MACs), the regional entities that process Medicare claims, were originally organized under HCFA and continue to operate under CMS today. Their roles include:

- Processing HCFA/CMS-1500 claims

- Enforcing medical necessity rules

- Educating providers on compliance

Private insurers often model their billing rules after these MAC-led CMS guidelines, meaning HCFA’s original structures continue to influence commercial billing standards too.

4. Essential for Compliance, Audits, and Appeals

During audits, appeals, or payment disputes, payers reference HCFA field data to validate medical necessity and billing accuracy. In 2026, a strong understanding of the HCFA form allows billing teams to respond faster, reduce rework, and protect reimbursement in an increasingly compliance-driven environment.

If you bill professional or outpatient services, mastering the HCFA (CMS-1500) structure remains essential in 2026 for clean claims, faster payments, and long-term revenue stability.

Understanding the CMS-1500 (HCFA) Form

The CMS-1500, commonly referred to as the HCFA form, is the standardized health insurance claim form used by non-institutional providers to bill for professional and outpatient medical services. This includes physicians, therapists, mental health professionals, and independent clinics.

The form is required by Centers for Medicare & Medicaid Services and accepted by Medicare, Medicaid, and most commercial insurance companies. Its structured format ensures that all essential claim details—such as patient information, diagnoses, procedures, provider identifiers, and charges—are reported consistently for accurate claim adjudication.

Although most claims are submitted electronically in 2026, the CMS-1500 structure remains the foundation for professional billing, not for hospital/facility billing, which uses the UB-04 form. Electronic claims (837P) follow the same field logic and validation rules as the HCFA paper form, making a clear understanding of this format essential for clean claims and timely reimbursement.

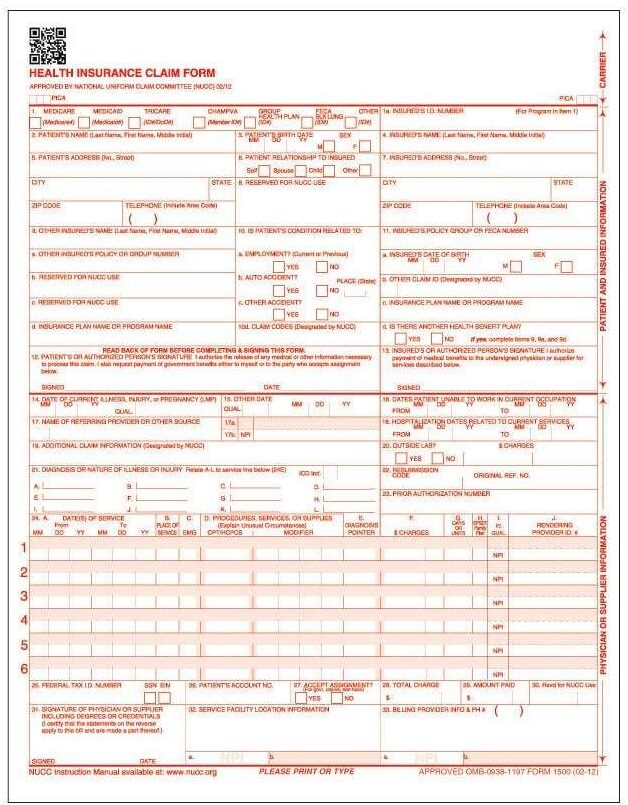

How Many Boxes Are on the HCFA 1500 Form?

The HCFA 1500 (CMS-1500) form contains 33 numbered boxes, each designed to capture a specific piece of information required to process a professional medical claim accurately.

Several of these boxes include subsections—most notably Box 24, which is divided into multiple fields to report dates of service, CPT/HCPCS codes, modifiers, charges, units, diagnosis pointers, and provider identifiers.

It is important to note that not every box is required for every claim. Required fields depend on:

The payer (Medicare, Medicaid, or commercial insurance)

The type of service provided

Whether the claim is primary, secondary, or corrected

Entering unnecessary or incorrect information can trigger rejections or delays, making it essential for billing teams to understand which boxes are mandatory and how they interact.

What Does Each Box Refer to in the HCFA Form?

Each box on the HCFA 1500 (CMS-1500) form serves a specific purpose in communicating claim details to insurance payers. These fields collectively explain who received care, what services were provided, why they were necessary, and who should be paid. Below is a focused breakdown of the most critical HCFA boxes that directly impact claim acceptance and reimbursement:

| Box No. | Field Label | Description / Use | Example Input |

|---|---|---|---|

| 1 | Insurance Type | Indicates type of insurance coverage | X in “Medicare” |

| 1a | Insured’s ID Number | Patient’s insurance policy or Medicare number | 123456789A |

| 2 | Patient’s Name | Full name of patient receiving services | John Doe |

| 3 | Patient’s Birth Date/Sex | DOB and gender | 01/01/1970, M |

| 4 | Insured’s Name | Name of the insurance policyholder (if different from patient) | Jane Doe |

| 5–11 | Patient and Insurance Info | Includes address, relationship, group ID, condition codes, etc. | Varies |

| 17 | Referring Provider | Required when services are referred | Dr. Emily Carter, NPI: 1234567890 |

| 21 | Diagnosis or Nature of Illness (ICD-10) | Primary and up to 12 ICD-10 diagnosis codes | F41.1, M54.5 |

| 24D | Procedures, Services, or Supplies | CPT/HCPCS code with up to 4 modifiers per line | 90837, 95 |

| 24E | Diagnosis Pointer | Links procedure code to the relevant diagnosis code from Box 21 | A, B, C |

| 24F | Charges | Fee charged for the line-item service | $150.00 |

| 24G | Days or Units | Number of units/time (as applicable per code) | 1 |

| 25 | Federal Tax ID | SSN or EIN of the billing provider | XX-XXXXXXX |

| 26 | Patient’s Account Number | Internal patient ID for provider’s recordkeeping | PT-022345 |

| 27 | Accept Assignment | Indicates whether provider accepts payer’s assignment/payment terms | YES |

| 28 | Total Charges | Total billed charges for all services listed in Box 24 | $450.00 |

| 31 | Signature of Physician/Provider | Must include provider signature or notation “Signature on File” | Signature on File |

| 32 | Service Facility Location | Location where services were rendered | 123 Main St, Houston, TX 77001 |

| 33 | Billing Provider Info & Phone # | Billing entity’s name, address, and contact | MedStates, 800-555-1234 |

Critical Boxes to Prioritize

- Box 21: ICD-10 codes — Must reflect medical necessity.

- Box 24D: Procedure (CPT/HCPCS) codes with correct modifiers.

- Box 33: Billing provider details — Must match payer credentialing records.

- Box 25 & 27: Can trigger rejections if mismatched with payer files.

What is the Claim Number on a HCFA Form?

The claim number, also known as the Claim Control Number (CCN) or payer claim number, is a unique identifier assigned by the insurance company after a HCFA (CMS-1500) claim is received and processed. This number is not entered by the provider on the HCFA 1500 form at the time of submission. Instead, it is generated by the payer and is used to track, reference, and manage the claim throughout its lifecycle.

Where to Find the Claim Number

Once the claim is processed, the payer-issued claim number can be found on:

Electronic Remittance Advice (ERA)

Payer portals and claim status reports

Insurance companies, including Medicare, Medicaid, and commercial payers, require this number for any claim-related communication.

Why the Claim Number Is Important

The claim number plays a critical role in day-to-day medical billing operations:

:

| Function | Description |

|---|---|

| Tracking | Allow providers to track the claim status across clearinghouses and payers. |

| Dispute Resolution | Essential when filing an appeal against denied claims or requesting reconsideration. |

| Coordination of Benefits (COB) | Helps insurer determine if they are primary or secondary payers. |

| Audit Trail | Offer a digital paper trail for compliance, audits, and payer correspondence. |

Claim Number vs Patient Account Number

While both numbers appear on EOB:

- Claim Number = Assigned by the insurance company (payer-side).

- Patient Account Number = Assigned by the provider’s billing system (provider-side).

Many denials and follow-ups are delayed due to this confusion. Ensuring your staff understands the distinction speeds up payer communication and appeal processing. Payers like Medicare, Medicaid, and Blue Cross Blue Shield each assign claim numbers differently. Including this number in appeals, resubmissions, and reconsideration requests is considered an industry best practice.

How the HCFA Form Relates to Insurance Companies

The HCFA form (CMS-1500) is the primary communication tool between healthcare providers and insurance companies for professional and outpatient medical claims. It standardizes how services are reported so payers can evaluate coverage, medical necessity, and reimbursement accurately. When a claim is submitted, insurance companies rely on HCFA-form data to determine who provided the service, what was performed, why it was necessary, and how payment should be issued.

Why Insurance Companies Rely on the HCFA Form

Insurance payers—including Medicare, Medicaid, and commercial plans—use the HCFA (CMS-1500) structure to:

Validate medical necessity using ICD-10 diagnosis codes linked to CPT/HCPCS procedures

Confirm provider eligibility through NPI, taxonomy, and credentialing details

Apply reimbursement rules based on modifiers, place of service, and units

Adjudicate claims consistently across different provider types and specialties

Because the HCFA form follows a nationally recognized format, it allows insurers to process claims efficiently and apply automated edits with minimal variation.

HCFA Standards and Electronic Claims

Even though most claims are submitted electronically in 2026, the HCFA structure still drives how insurers process claims. Electronic professional claims (837P) are built directly from HCFA field logic, meaning errors at the box level can still result in:

Claim rejections

Medical necessity denials

Incorrect payment calculations

Clearinghouses and payer systems continue to “read” claims as if they were HCFA forms, just in digital format.

How HCFA Affects Claim Decisions

Insurance companies use HCFA data to support:

Coordination of Benefits (COB) – determining primary vs secondary responsibility

Utilization review – verifying appropriate use of services

Fraud and abuse detection – identifying duplicate or inconsistent billing patterns

Incomplete or inaccurate HCFA data increases the likelihood of payer follow-ups, audits, or delayed payments.

State-Level Differences in HCFA (CMS-1500) Billing

While the HCFA (CMS-1500) form follows a standardized national structure, how claims are processed and reimbursed can vary by state due to differences in Medicaid programs, payer policies, and regulatory requirements. These variations do not change the form itself but affect how specific fields are reviewed and enforced.

State Medicaid programs often apply additional rules to HCFA-based claims, such as authorization requirements, taxonomy validation, or documentation standards. For example, some states require stricter matching between service location (Box 32) and credentialed practice addresses, while others closely monitor modifier usage for behavioral health or telehealth services.

Commercial insurers may also apply state-specific edits based on local insurance regulations. Timely filing limits, telehealth modifiers, and supervision requirements can differ from one state to another, even when the same CMS-1500 format is used. Claims that meet federal HCFA standards may still be denied if they do not align with state-level payer rules.

For billing teams managing multi-state practices, understanding these state-level differences is essential. Maintaining payer- and state-specific billing checklists, verifying credentialing details, and reviewing local Medicaid manuals can significantly reduce denials and improve reimbursement accuracy.

🏥 Medicaid and HCFA: Not One Size Fits All

Each state runs its own Medicaid program with unique claim submission protocols and coverage criteria even though HCFA/CMS-1500 form is used across all the U.S. States.

| State | Unique HCFA Billing Consideration |

|---|---|

| California | Medi-Cal requires special Treatment Authorization Requests (TAR) with HCFA. |

| New York | Medicaid claims may require additional attachments or documentation identifiers. |

| Texas | HCFA must align with TMHP guidelines or else wrong taxonomy codes can trigger denial. |

| Florida | May require NPI crosswalks if rendering and billing provider differ. |

🗺️ Commercial Insurance Rules Vary by State

Private insurance carriers often comply with state insurance department mandates, affecting how they interpret and reimburse claims submitted via HCFA.

Examples include:

- Timely filing limits may vary (e.g., 90 days in some states, 180 in others).

- Telehealth modifiers (like 95 or GT) might be required or denied depending on local policy.

- Balance billing restrictions impact what providers can charge after payer reimbursement.

Common HCFA Claim Errors and How to Avoid Them

⚠️

Even small mistakes on the HCFA 1500 (CMS-1500) form can lead to claim rejections, denials, or delayed payments. Most HCFA-related issues stem from incorrect field usage, missing data, or payer-specific rule mismatches. Below are the most common HCFA claim errors that impact reimbursement—and how to prevent them.

Top 7 HCFA Claim Errors

| Error | Description | Impact |

|---|---|---|

| Missing or Invalid NPI | Fields 24J, 33a not completed properly. | Claim may be rejected or routed incorrectly. |

| Incorrect ICD-10 Code Version | Box 21 misused or diagnosis codes not updated for current fiscal year. | Immediate denial or underpayment. |

| Mismatched Modifiers | Modifiers like 25, 59, or 95 used incorrectly in Box 24D. | Can flag claim for medical necessity audit or denial. |

| Missing Authorization Numbers | Pre-auth not noted in Box 23. | Auto-denial for services requiring prior authorization. |

| Improper Patient Demographics | Errors in Box 2–5 (name, DOB, gender). | Claim rejections due to identity mismatch. |

| Invalid Place of Service Code | Box 24B code doesn’t match procedure (e.g., POS 11 vs 02 for telehealth). | Reimbursement discrepancy or outright denial. |

| Unlinked Diagnosis and Procedure | No pointer from CPT to relevant ICD code in Box 24E. | Claim gets flagged for incomplete medical necessity documentation. |

How to Avoid These Errors

- Use Practice Management Software (PMS) with built-in HCFA validation.

- Audit your claims weekly to address rejection trends.

- Keep payer-specific rules handy for high-volume insurance companies.

- Continuous training and learning of billing staff in accordance with CMS/AMA updates.

- Use electronic clearinghouses that pre-scrub for HCFA form compliance.

- Confirm patient insurance eligibility and pre-authorizations before scheduling for services.

- Reconcile Box 24 and 33 for consistent rendering and billing provider NPI data.

❓

Why Reducing HCFA Errors Matters

Minimizing HCFA claim errors leads to:

Faster claim approvals

Fewer denials and appeals

Reduced accounts receivable (AR) days

Improved cash flow and payer relationships

In 2026, payers rely heavily on automated edits tied directly to HCFA field accuracy, making error prevention more critical than ever.

📈

Submitting the HCFA 1500 Form: Manual vs. Electronic

In 2026, most healthcare providers submit HCFA 1500 (CMS-1500) claims electronically, but paper submission is still required in certain situations. Understanding when to use each method helps avoid delays and payer rejections.

Electronic Submission (837P)

Electronic claims submitted through clearinghouses remain the preferred method for most payers. Advantages of electronic submission:

- Faster claim processing and reimbursement

- Built-in validation and error checking

- Lower rejection rates

- Required by Medicare and most commercial insurers

Electronic submissions use the ANSI X12 837P format, which is mapped directly to HCFA field logic. Even though the claim is digital, accuracy at the HCFA box level is still critical.

Paper Submission (HCFA 1500)

Paper claims are less common but still accepted or required in specific cases, such as:

- Secondary or tertiary insurance claims

- Corrected or resubmitted claims with documentation

- Certain out-of-network or retroactive claims

- Payers or programs that do not support EDI

When submitting paper claims, providers must use official CMS-1500 red-ink forms and follow strict formatting guidelines to avoid scanning or processing errors.

💡 Tip for Providers: Always check payer-specific requirements; some insurers request paper forms for coordination of benefits or retro-authorized visits.

Conclusion

Although HCFA is no longer the name of a federal agency, its influence on medical billing remains firmly in place. The CMS-1500 form—still commonly referred to as the HCFA form—continues to serve as the standard framework for professional and outpatient claims across Medicare, Medicaid, and commercial insurance plans. Even as billing systems evolve and electronic submissions dominate, the underlying HCFA structure defines how services are reported, validated, and reimbursed.

Understanding HCFA is not just about terminology; it directly impacts claim accuracy, payer communication, and reimbursement outcomes. Providers and billing teams who understand how HCFA fields, coding rules, and payer requirements work together are better equipped to reduce denials, respond to audits, and maintain compliance in an increasingly automated and regulated billing environment. As healthcare billing continues to modernize beyond 2025, HCFA principles remain a critical foundation for clean claims, efficient revenue cycles, and long-term financial stability.

Frequently Asked Questions

Below are answers to the most common questions providers and billing teams ask about the HCFA (CMS-1500) form, based on real-world billing and payer requirements.