Electronic Remittance Advice in Medical Billing

In medical billing, accurate and timely reimbursements mean everything to providers in the U.S. healthcare industry. Medical providers rely on smooth payment cycles to keep their practices financially healthy, but traditional paper-based claim updates often cause delays, confusion, and errors. This is where the Electronic Remittance Advice (ERA) plays a game-changing role.

ERA in medical billing is the electronic version of explanation of benefits (EOB) that providers receive from payers, making claim reconciliation faster, simpler, and more accurate

BLOG OUTLINE

- Introduction – Understanding ERA in Medical Billing

- What is ERA in Medical Billing?

- Purpose of ERA in Healthcare

- How ERA Works in Medical Billing

- ERA in Insurance & Medicare

- Who Uses ERA in Medical Billing?

- ERA Applicability Across States

- ERA vs. EOB (Detailed Comparison)

- Benefits of Using ERA for providers

- How to Set Up ERA for Your Practice

- ERA in the Future of Healthcare Billing

- MedStates: Helping Providers with ERA & Billing Success

- FAQs

Electronic Remittance advice

Electronic Remittance Advice, ERA is an electronic document sent by insurance companies to healthcare providers to explain how the claims were processed, approved amounts with details thereof, reason of claim denial, adjustments and patient responsibilities (if any). Unlike paper based Explanation of benefits (EOB), ERA is faster, standardized, and easier to integrate with medical billing systems.

With the advancement of technology in medical billing and increasing use of integrated tools, it has become necessary for providers, medical billers, and practice managers to understand ERA to manage revenue cycle efficiency efficiently and staying compliant across all U.S. states. Continue reading to learn what an ERA is, why it matters, how it differs from an EOB, and why every medical provider should adopt ERA for smoother billing operations.

In expanding medical billing landscape, ERA is not just a convenience rather a necessity. With claim volumes increasing and payers moving toward digital-first processes, ERA helps streamline revenue cycle management, speed up payment reconciliation, and reduce administrative burdens.

Who uses ERA? Nearly everyone in the billing ecosystem including healthcare providers, billing companies, clearinghouses, and insurance payers—relies on ERA to ensure claims are processed accurately and efficiently.

What is ERA in Medical Billing?

ERA Full Form in Medical Billing

ERA stands for Electronic Remittance Advice, a digital document that explains how insurance companies process submitted medical claims.

What Does ERA Stand For in Medical Billing?

In simple terms, ERA is the electronic version of an Explanation of Benefits (EOB). Instead of sending bulky paper EOBs, payers now transmit electronic files directly to providers or billing systems.

ERA Meaning in Healthcare and Insurance

In healthcare and insurance, an Electronic Remittance Advice (ERA) provides detailed information about claim payments, including the amount paid by the insurance company versus the patient’s responsibility. It also outlines denial reasons, explaining why certain charges were reduced or denied, and specifies adjustments such as contractual obligations, write-offs, or copays. This information is essential for ensuring accuracy in claim reconciliation and maintaining reliable financial reporting.

Purpose of ERA in Healthcare

The purpose of Electronic Remittance Advice (ERA) goes beyond just delivering payment details. It plays a vital role in simplifying revenue cycle management and keeping healthcare organizations financially healthy.

1. Claim Adjudication and Payments

With ERA, providers instantly see how claims were processed — approved, denied, or adjusted. This eliminates delays tied to paper-based explanations and speeds up payment posting.

2. Faster Communication Between Payers and Providers

Instead of waiting days for a mailed Explanation of Benefits (EOB), ERAs arrive electronically in real time. This allows providers to quickly respond to payer decisions, refile denials, or reconcile accounts.

3. Reducing Manual Errors and Administrative Burden

Paper EOBs require manual entry, which often leads to data entry errors. ERA automates this process, ensuring cleaner claim records, reduced rework, and fewer billing mistakes.

4. Enhancing Revenue Cycle Management (RCM) Efficiency

By delivering claim outcomes directly into billing software, ERAs make revenue cycle management more efficient. Providers can track reimbursements, manage denials proactively, and maintain a steady cash flow.

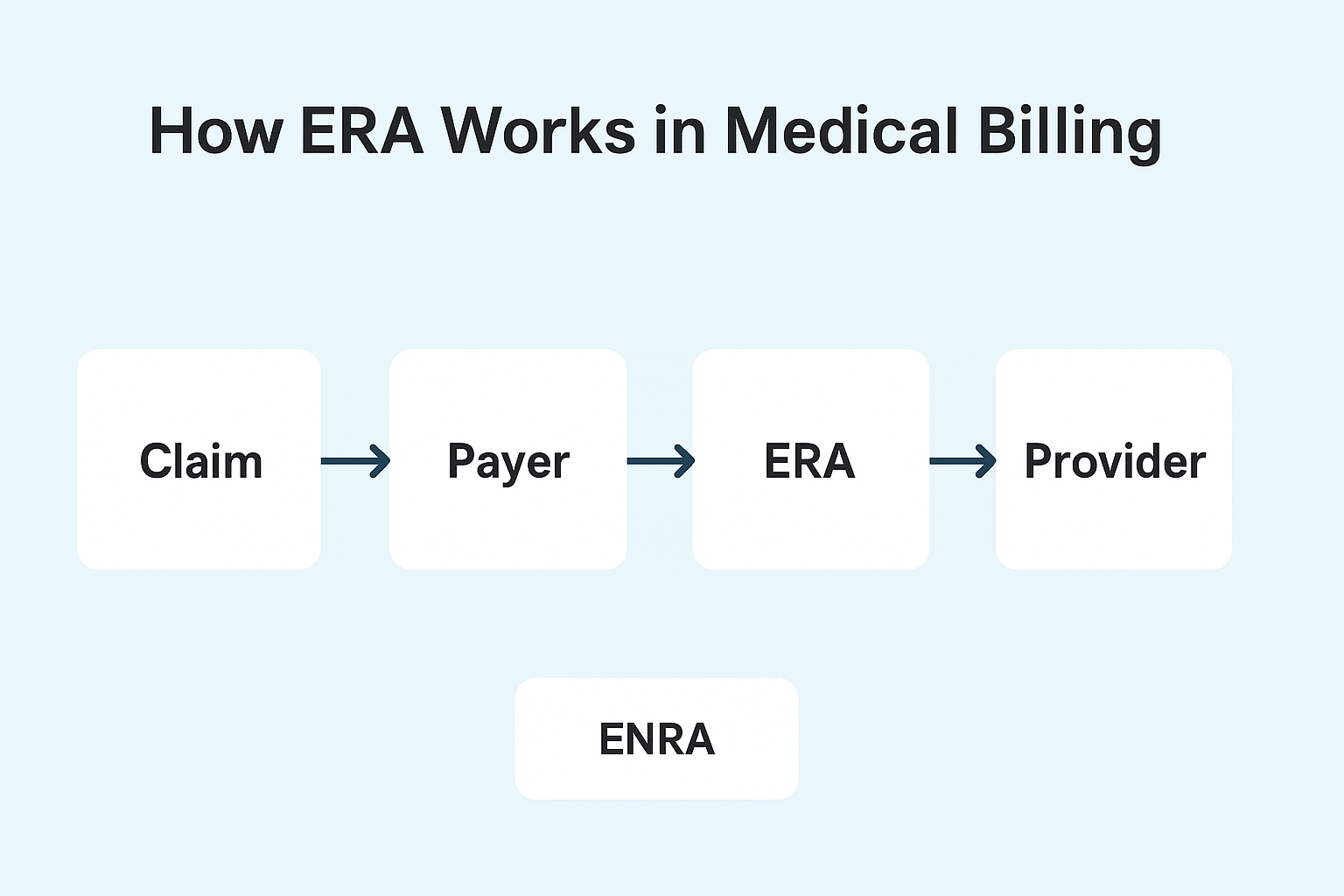

How ERA Works in Medical Billing

Understanding how Electronic Remittance Advice (ERA) works helps providers and billers see where it fits into the revenue cycle. The process is straightforward but powerful:

🧾

The provider submits a claim to the payer (insurance company or government program) after delivering services to a patient.

2. Payer Review

📤

The payer reviews the claim for accuracy, eligibility, coding, and coverage. This step determines whether the claim is approved, denied, or adjusted.

3. ERA Generation

✅

The payer reviews the claim for accuracy, eligibility, coding, and coverage. This step determines whether the claim is approved, denied, or adjusted.

4. Provider Reconciliation

📧

The payer reviews the claim for accuracy, eligibility, coding, and coverage. This step determines whether the claim is approved, denied, or adjusted.

Modern practice management systems (PMS) and EHRs are designed to accept ERA files. This integration allows automatic payment posting, eliminates manual data entry, and creates a more transparent workflow for billing teams and providers.

ERA in Insurance & Medicare

Electronic Remittance Advice (ERA) plays a central role in both commercial insurance billing and Medicare claims processing.

What is ERA Insurance?

In insurance, ERA refers to the electronic file that communicates how a claim was processed—approved, denied, adjusted, or partially paid—directly from the payer to the provider.

ERA Payment Meaning in Insurance

An ERA payment in insurance is not the money itself, but the digital record of the payment details. It explains payment amounts, reasons for denials, and adjustments made by the payer.

What is an ERA Payment?

While the term “ERA payment” is often used, technically it refers to the remittance advice linked to the actual payment (usually transferred electronically via EFT – Electronic Funds Transfer). Together, ERA + EFT provide transparency and efficiency.

Medicare ERA

Medicare mandates the use of ERAs for claim adjudication. Providers receive ERA files (ANSI 835 format) that outline:

- Claim payment details

- Adjustment codes (CARC & RARC)

- Patient responsibility (deductible, coinsurance, copay)

This eliminates the need for paper remittance notices.

Commercial Payers vs Medicare ERA Requirements

- Medicare: ERA and EFT enrollment is standardized and often mandatory.

- Commercial Payers: Each insurer may have different ERA enrollment processes, formats, or portal access, creating variability for providers.

- Medicare is uniform and regulated, while commercial payers can be fragmented and less consistent in ERA workflows.

Medicare vs. Commercial ERA Requirements

| Feature / Requirement | Medicare ERA | Commercial ERA |

|---|---|---|

| Format | ANSI X12 835 (standardized nationwide) | ANSI X12 835 (but may vary by payer) |

| Enrollment Process | Centralized via Medicare Administrative Contractors (MACs) | Separate enrollment with each payer/clearinghouse |

| Mandatory Use | ERA is required for most providers | ERA use encouraged but not always mandatory |

| Payment Link | ERA always linked to EFT (Electronic Funds Transfer) | May link to EFT, but sometimes issued separately |

| Adjustment Codes | Uses standardized CARC & RARC codes | May use standard codes but interpretation can differ |

| Uniformity | Highly consistent across the U.S. | Varies widely between insurance carriers |

| Processing Speed | Faster, regulated by CMS timelines | Depends on payer’s internal systems |

| Compliance / Regulation | Governed by federal CMS rules | Governed by payer policies & state rules on format |

Who Uses ERA in Medical Billing?

Electronic Remittance Advice (ERA) is not limited to one type of provider—it applies across the entire healthcare industry. Any provider who bills insurance or Medicare can benefit from ERA, but the impact varies by specialty and practice size.

Does ERA apply to all Providers?

Yes. ERA is available to all providers who submit claims electronically, including physicians, hospitals, rehabilitation centers, behavioral health clinics, and even small private practices. While some providers still receive paper EOBs (Explanation of Benefits), ERA adoption is now the industry standard due to speed and accuracy.

Benefits for Different Specialties

- Mental Health Providers – Streamlines high-volume, lower-cost claims (therapy sessions, psychiatry visits) and reduces manual posting errors.

- Internal Medicine Practices – Handles complex claims with multiple procedures, lab tests, and chronic care services efficiently.

- Rehabilitation Clinics – Improves tracking of recurring services like physical therapy or inpatient rehab, where billing frequency is high.

- Surgical & Specialty Care – Helps reconcile bundled or complex payments quickly.

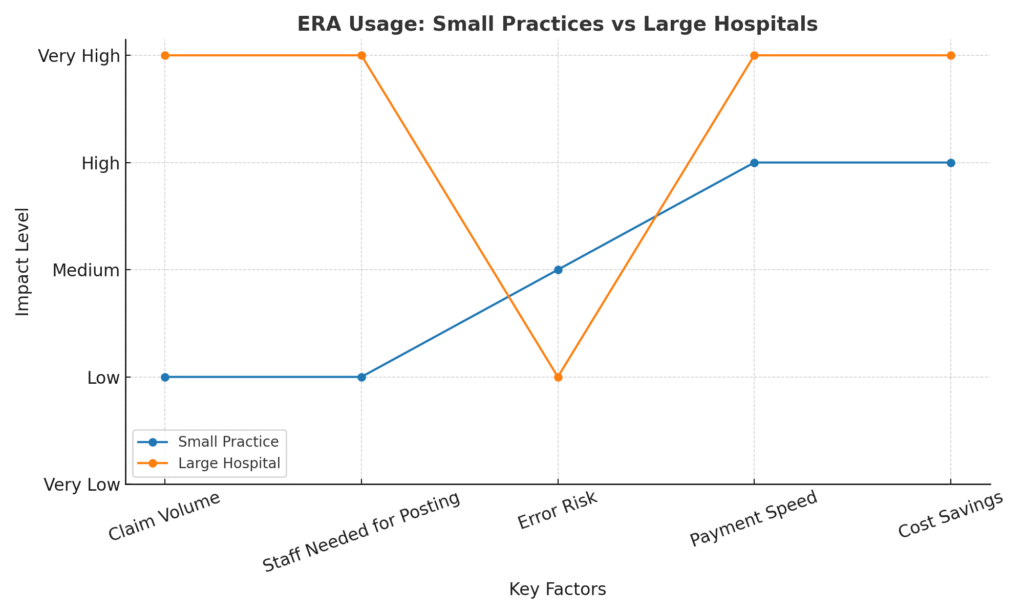

Small Practices vs. Large Hospitals

Small Practices – ERA eliminates the burden of manual EOB posting, saving administrative time and reducing billing costs. Even a solo mental health therapist or family doctor can cut claim posting time significantly.

Large Hospitals & Health Systems – With thousands of claims daily, ERA is essential for bulk posting, managing denials, and integrating with revenue cycle management systems.

ERA is universal—from a one-provider clinic to a multi-state hospital network, everyone benefits from faster payments, reduced errors, and better financial transparency

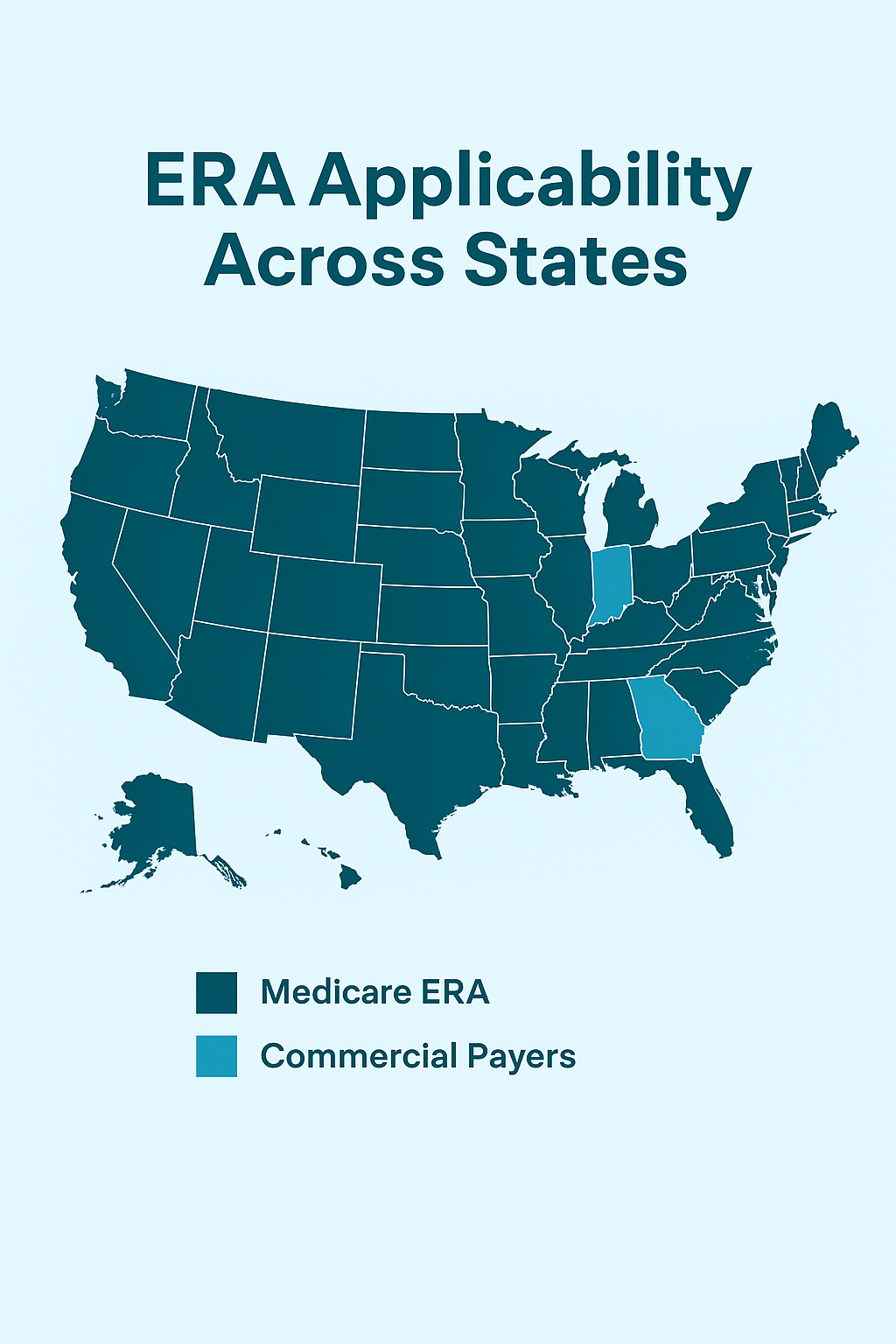

ERA Applicability Across States

Electronic Remittance Advice (ERA) is federally regulated and recognized across all U.S. states, but its adoption and implementation may differ by payer and region.

- Nationwide Standard – ERA uses the HIPAA-compliant ANSI 835 format, which is mandated for all HIPAA-covered entities, ensuring consistency across states.

- CMS Regulations – Medicare requires payers to offer ERA to providers, making it universally applicable for Medicare claims.

- Commercial Payer Variations – While most large insurers support ERA, some regional or smaller payers may still have partial adoption or require additional enrollment steps.

- State-Level Differences – Certain states have stronger mandates for electronic transactions, while others leave more flexibility to providers and payers.

- Practical Takeaway – Providers in all states can use ERA, but the ease of enrollment, payer readiness, and level of integration may differ.

👉 This means that ERA is applicable in every U.S. state, but its efficiency depends on payer policies and local adoption trends

Issues Pertaining to Electronic Remittance Advice

While Electronic Remittance Advice (ERA) improves efficiency, providers often face challenges that can impact revenue cycle management. Below are some of the most frequent issues:

ERA Payer Denied Claims

Sometimes ERA files indicate claim denials without sufficient explanation. Billing teams must carefully review denial codes to determine if it’s a payer error, a coding issue, or missing documentation.

Status: ERA Not Received

Providers may submit clean claims but never receive the ERA file. This could be due to payer delays, clearinghouse errors, or provider setup issues. Without ERA, posting payments becomes manual and time-consuming.

Missing or Delayed ERA Files

Even after enrollment, ERA files can get delayed, leading to posting backlogs. Common causes include system downtime at payers, transmission failures, or mismatched provider identifiers.

ERA vs. EOB Confusion

Some providers still confuse ERA with Explanation of Benefits (EOB). While both outline payments and denials, ERA is electronic and designed for automated posting, whereas EOB is a paper-based version. Misunderstanding the difference can slow down billing processes

ERA vs. EOB: Key Differences

| Feature | ERA (Electronic Remittance Advice) | EOB (Explanation of Benefits) |

|---|---|---|

| Format | Electronic (ANSI X12 835 file) | Paper-based document |

| Delivery | Sent electronically via clearinghouse or payer portal | Mailed directly to provider/patient |

| Automation | Enables auto-posting into billing software | Requires manual data entry |

| Speed | Faster, real-time or near real-time | Slower, depends on postal delivery |

| Usage | For providers and billing staff | For both providers and patients |

| Details Included | Payment info, denial codes, adjustments, claim status | Payment info, patient responsibility, service details |

| Efficiency | Reduces human errors, speeds up cash flow | More prone to delays and manual mistakes |

Detailed Comparison of ERA Versus. EOB

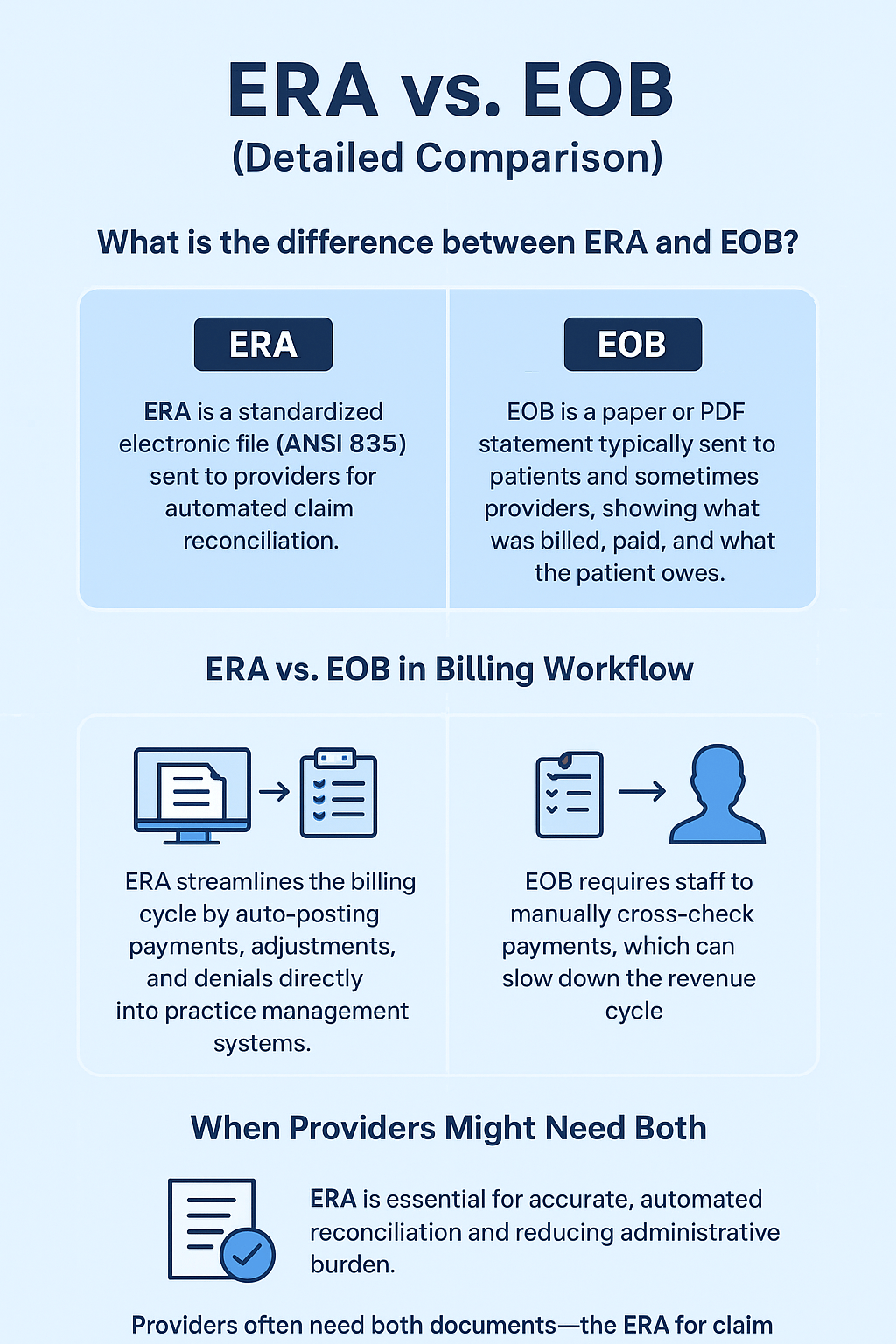

What is the difference between ERA and EOB?

While both ERA (Electronic Remittance Advice) and EOB (Explanation of Benefits) communicate claim payment information, they differ in format, audience, and functionality. An ERA is a standardized electronic file (ANSI 835) sent to providers for automated claim reconciliation, while an EOB is a paper or PDF statement typically sent to patients and sometimes providers, showing what was billed, paid, and what the patient owes.

What is the difference between ERA and EOB?

- ERA streamlines the billing cycle by auto-posting payments, adjustments, and denials directly into practice management systems.

- EOB requires staff to manually cross-check payments, which can slow down the revenue cycle.

- Many payers issue both ERA and EOB, but providers rely more heavily on ERAs for operational efficiency.

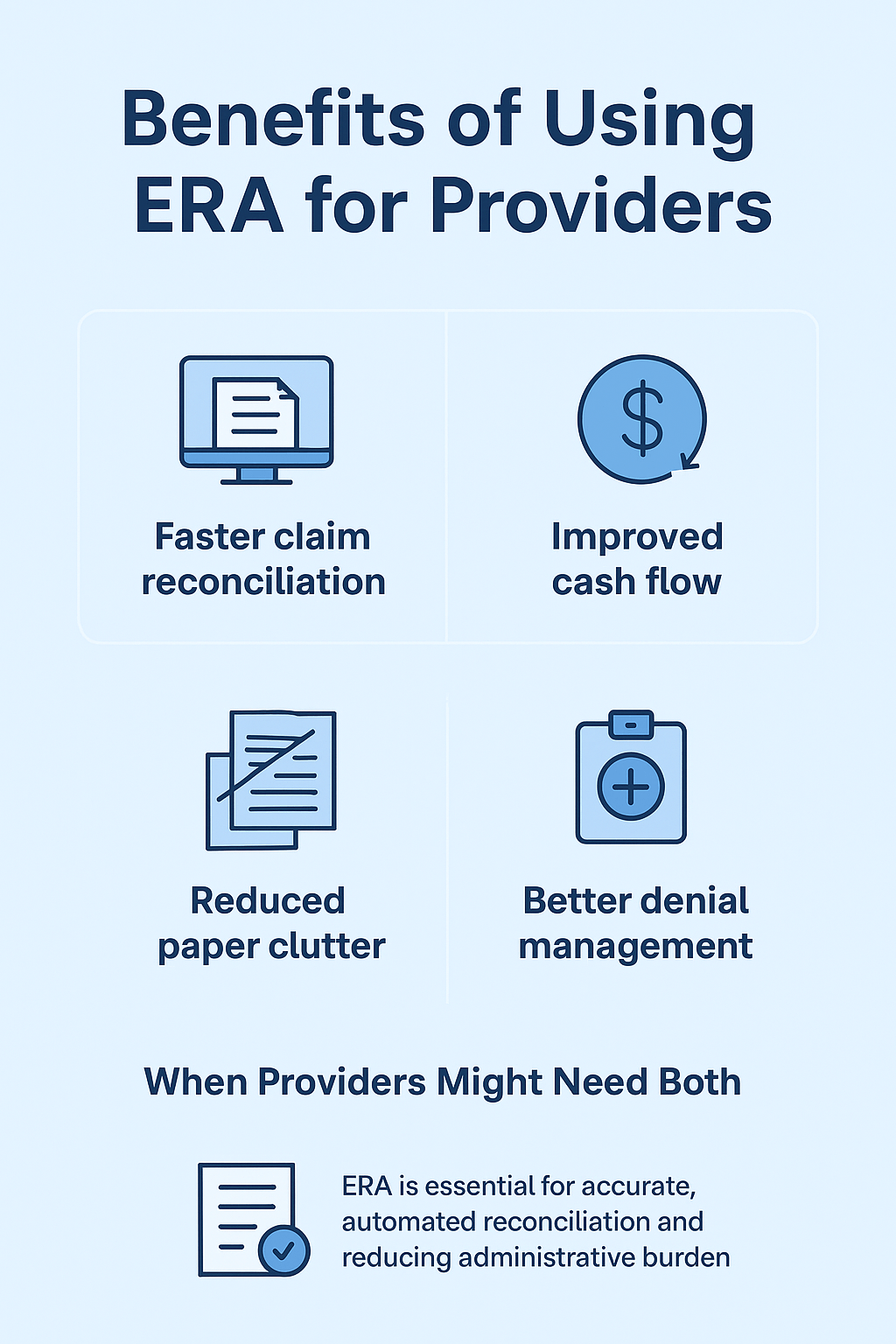

When Providers Might Need Both

- ERA is essential for accurate, automated reconciliation and reducing administrative burden.

- EOB serves as a patient-friendly explanation of financial responsibility.

- Providers often need both documents—the ERA for claim posting and the EOB for patient communication and dispute resolution

Benefits of Using ERA for providers

How to Set Up ERA for Your Practice

📝 Enrolling with Payers for ERA

- Complete payer-specific ERA enrollment forms.

- Some allow online submission; others require fax/mail.

- Specify delivery to clearinghouse, EHR, or direct.

- Track requirements & timelines—processing can take weeks.

1

⚙️ ERA File Setup with Clearinghouses /EHR

- Complete payer-specific ERA enrollment forms.

- Some allow online submission; others require fax/mail.

- Specify delivery to clearinghouse, EHR, or direct.

- Track requirements & timelines—processing can take weeks.

2

👩🏫 Staff Training for ERA Reconciliation

- Train staff to read & interpret ERA files.

- Define a workflow for denials & partial payments.

- Clarify differences between ERA vs EOB.

- Run periodic refreshers as payer rules/EHR features change.

3

ERA in the Future of Healthcare Billing

1. Transition to Fully Automated Revenue Cycle Management (RCM)

- ERA is becoming central to end-to-end automation of billing, from claims submission to payment posting.

- Fully automated RCM minimizes manual posting errors, reduces denials, and speeds up cash flow.

- Practices will increasingly rely on systems that integrate ERA, EFT (Electronic Funds Transfer), and claim status checks for seamless payment workflows.

2. AI and ERA Integration

- Artificial Intelligence (AI) will analyze ERA data to predict denials, payment delays, and underpayments.

- AI-powered tools will auto-correct common billing errors before resubmission.

- Integration of AI with ERA will help practices identify payer trends, reduce revenue leakage, and optimize contract negotiations.

3. Impact on Patient Billing Transparency

- ERA will play a bigger role in creating clear, real-time patient statements.

- Automated posting means patients see accurate balances faster, reducing confusion about insurance vs. patient responsibility.

- Future systems will allow patients to access ERA-based breakdowns through patient portals, improving trust and payment compliance.

MedStates: Helping Providers with ERA & Billing Success

At MedStates, we take the complexity out of ERA processing by combining expert billing knowledge with advanced technology. Our specialists manage ERA posting with precision, quickly identify and resolve discrepancies, and minimize denials to keep your revenue cycle running smoothly. With proper integration into your EHR and clearinghouse systems, we ensure every payment is accurately recorded, saving you hours of administrative work while maintaining compliance and transparency.

By outsourcing ERA reconciliation to MedStates, providers not only reduce the burden on their in-house staff but also gain faster claim settlements, improved cash flow, and greater peace of mind. Our team delivers timely posting, efficient denial management, and clear reporting that keeps you in control of your practice’s financial health. If your team is struggling with payment posting or reconciliation delays, let MedStates step in and simplify the process so you can focus fully on patient care. Contact us today for a free consultation and discover how our ERA expertise can boost your billing success.